National Tax Number Registration

In Pakistan, if you are running a business or involved in certain financial activities, you might come across the term NTN registration. Thus, Federal Board of Revenue (FBR) national Tax Number or NTN registration number to an individual, company, or Business. Basically, it involves the process by which you can register yourself or your business with the Federal Board of Revenue (FBR). Furthermore, NTN Registration is very basic requirement for businesses in Pakistan. Finally, After getting registered, you will be assigned a unique identification number or NTN, which is used as an identification number for various tax purposes. TENCO is ready to guide you though the process of NTN Registration and help you strengthen your businesses.

Additionally, FBR-Iris online portal by the Federal Board of Revenue (FBR) is an online Verification system. It is a portal to the world of taxes. To file your income tax returns you must be first registered with FBR. Therefore, by using this portal, you can verify ntn details. Individual, firms, AOPs and companies can use FBR IRIS Portal to get National Tax Number NTN. Various tax related information can also be verified.

What is NTN (National Tax Number)?

NTN stands for National Tax Number. It is also known as Income Tax Registration Number or simply Registration Number. Federal Board of Revenue (FBR) of Pakistan issues National Tax Number (NTN) is an ID or identification number for a business when you get e-enrolled in FBR iris Portal. It serves as a unique verification tool for businesses registered to pay income tax. It verifies that a business is registered with FBR and is compliant with tax regulations. Henceforth, to conduct any Taxable activity, businesses and Individuals liable for income tax must possess an NTN. Getting NTN number is very essential in Imports and Exports of various goods.

- Individuals with a CNIC can use their 13-digit CNIC number as their NTN.

- Businesses and AOPs (Associations of Persons): Assigned a unique 7-digit NTN upon registration with the FBR. Businesses need to register online through the FBR’s Iris portal. The process requires basic business and personal information.

- Non-resident individuals with taxable income in Pakistan (their Passport number acts as the NTN)

National Tax Number: NTN Registration

There are two types of Registration Processes

- Online Registration Process

- In-Person Registration Process

As shown above, you can register online through the FBR’s Iris portal. Basically, this process of registration with the Federal Board of Revenue (FBR) varies depending on an individual, a company, a partnership, or an Association of Persons (AOP). Thus, the registration process involves providing basic information about yourself and your business. Specifically, at TENCO, we are providing you with the best services for your business. you can contact TENCO to get your NTN registration for your company and business in any city in Pakistan. Our professional team and Experts are here to help you to get your NTN registration. Hence, we will assist you with completing the application forms accurately and efficiently.

Documents Required for NTN Registration

Consequently, you can register online through the IRIS Portal. For this purpose, NTN Registration requires certain documents. Requirement of documents vary according to type of ownership of business. It varies for individual, Firm, Company, Partnership or Association of Persons (AOP). Following are the requirements for NTN Registration.

NTN Registration requirements for Sole Proprietor

Before registration process, following documents you must have:

- Mobile phone number SIM must be registered against your CNIC

- Personal email address

- CNIC of Owner/CEO

- Proof of Business Address

NTN Registration for Company

For Company NTN Registration you must have following:

- Mobile phone number must be registered against your CNIC (not already used in FBR)

- Email address of a company

- CNIC’s of all Directors

- Incorporation Certificate

- Memorandum & Articles of Association

- Partnership registration certificate✓

- Rent agreement/ownership docs of Office premises

- Letterhead

- Latest paid electricity bill

NTN Registration for Partnership/Association of Persons (AOP)

For NTN Registration of AOP, following documents you must have,

- Mobile phone number must be registered against your CNIC (not already used in FBR)

- Email Address of AOP

- CNIC’s of All Members/ Partners

- Partnership Deed

- Partnership registration certificate

- Rent agreement/ownership docs of Office premises

- Letterhead

- Latest paid electricity bill

National Tax Number NTN Verification

NTN verification can be done online. The Process is really simple and straightforward. This is four to five steps simple process.

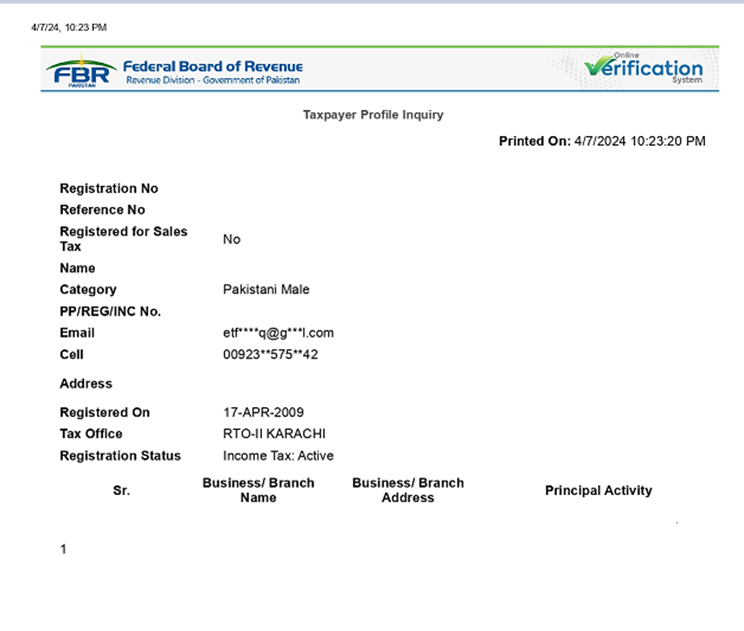

Taxpayer Profile Verification

Certainly, you can verify your tax profile in FBR Iris Portal. The FBR’s e-Services portal allows you to check your taxpayer profile using your NTN, CNIC, Passport No. or Incorporation No.

Step by step verification process

Firstly, go to Taxpayer Profile Inquiry in left Panel. Then enter your information by selecting parameter type that are NTN, CNIC (in case of Individual), Passport No, or Incorporation No. Then enter the respective registration number, enter captcha. Finally, click verify and get your NTN.

NTN Status

National Tax Number Status or simply NTN Status refers to the registration status of an individual or business with tax authorities in Pakistan. It is a tool for tax authorities to assess and monitors Taxpayer’s adherence to legal tax obligations to ensure the transparency and accountability within Tax framework. NTN Status can active, non-active, suspended,canceled or pending.

Active Taxpayer List ATL (Income Tax)

Using the FBR’s e-Services portal, you can verify active online status of your NTN. Active status shows validity of Taxpayer’s NTN and shows that taxpayer is fulfilling tax obligations which includes registration, returns filing or tax payment. For verification, please visit here

Step by Step process

Firstly, go to Active Taxpayer List atl (Income Tax) and check your active taxpayer status of Income Tax. Enter the required information Parameter type selection, enter registration number, date and captcha. Finally, click verify and get Active taxpayer list.

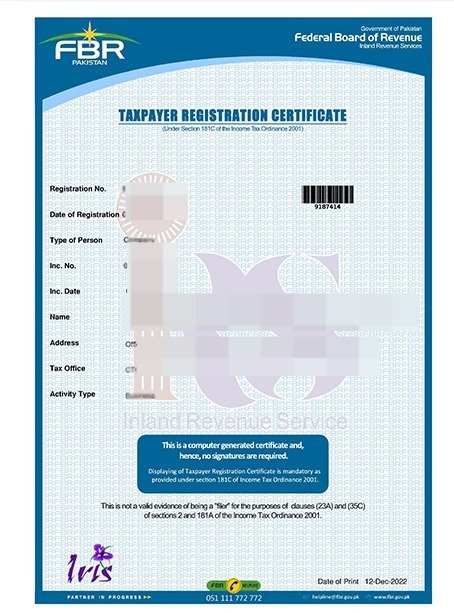

NTN Registration Certificate

An official document is issued by tax authorities to individuals and businesses called as National Tax Number or ntn Certificate upon successful registration for tax purposes. It typically include taxpayer information such as name, address and contact information. It also contain NTN number which is 13-digits CNIC number for individual, 7-digits ntn number for Business and Passport for non-resident individuals and local or regional tax office. Some NTN registration certificates may include an expiry date, indicating the validity period of registration . So, to maintain compliance with tax laws taxpayers require to renew their registration before the expiry date.

Online Login and Registration

Online login and registration for National Tax Number or ntn have emerged as useful tool in all type of tax-related processes. Through online portal of FBR Iris provided by tax authorities, individuals and businesses can easily register for an NTN, a unique identification number for tax transactions and communications. The process typically involves providing necessary personal or business information, verifying identity, and completing registration forms online. Once you get register, you can gain access to a range of tax-related services, including filing tax returns, making payments, and accessing tax-related documents.

Online login enables very safe and secure access to tax profiles, empowering taxpayers to manage their obligations efficiently from anywhere with an internet connection. Moreover, it promotes transparency and accountability in tax administration by facilitating real-time tracking of tax-related activities and enabling seamless communication between taxpayers and tax authorities. Overall, the registration through online systems marks a significant step towards modernizing tax systems and promoting the digitization of tax related activities.

Benefits for NTN Registration

Having NTN is very necessary, whether you are doing business or individual Taxpayer. For individual Taxpayer. It is very beneficial for Personal Financial Planning of an individual. It is very essential for pointing complexities in tax systems. It is really necessary if you want to get register with any government bodies like Federal Board of Revenue (FBR), Khyber Pakhtunkhwa Revenue Authority (KPRA), Sindh Revenue Authority (SRB), Punjab Revenue Authority (PRA), and Balochistan Revenue Authority (BRA).

Who is filer?

A filer are individuals who have registered with the tax authority and filed Income Tax Returns. Becoming filer have certain benefits such as transparency, assets buying and facilitating the collection of government Revenues.

Difference between filer and non-filer?

| Feature | Filer | Non-filer |

| Status of Registration | Registered with Tax Authority | Not registered with Tax Authority |

| Tax Returns Filing | Filed Income Tax Returns | No Filed Income Tax Returns |

| Benefits | They can claim Deductions and Credits, Potentially receive tax refunds, access to certain benefits and privileges, such as easier access to loans, buy assets, etc | No Access to Credits and may face difficulty, restrictions such as opening bank accounts and penalties. |

NTN Registration cost

NTN registration will cost you Pakistani rupees 15,000/- for sole business registration and its is the process of 1-4 working days depending on business type. It is an online procedure. Firstly, you have to sign up for FBR iris portal. Owner will receive codes on his/her email and phone number. After adding relevant codes and entering refreshed captcha, you will be directed to a page. A message will pop up on your laptop screen saying that your username and password is sent to registered contact. Then after that you can proceed further accordingly.

Why NTN registration is recommended?

NTN registration is very beneficial for your business. If you are taking the initiative, then NTN can give identity to your business. It gives legal and authentic recognition to your business. For more details, please feel free to contact us at given link.